Fixed Deposit Schemes

Money invested under this plan provide fixed monthly or quarterly income by way of interest to the depositor for a specified period leaving the amount intact.

Features and Benefits

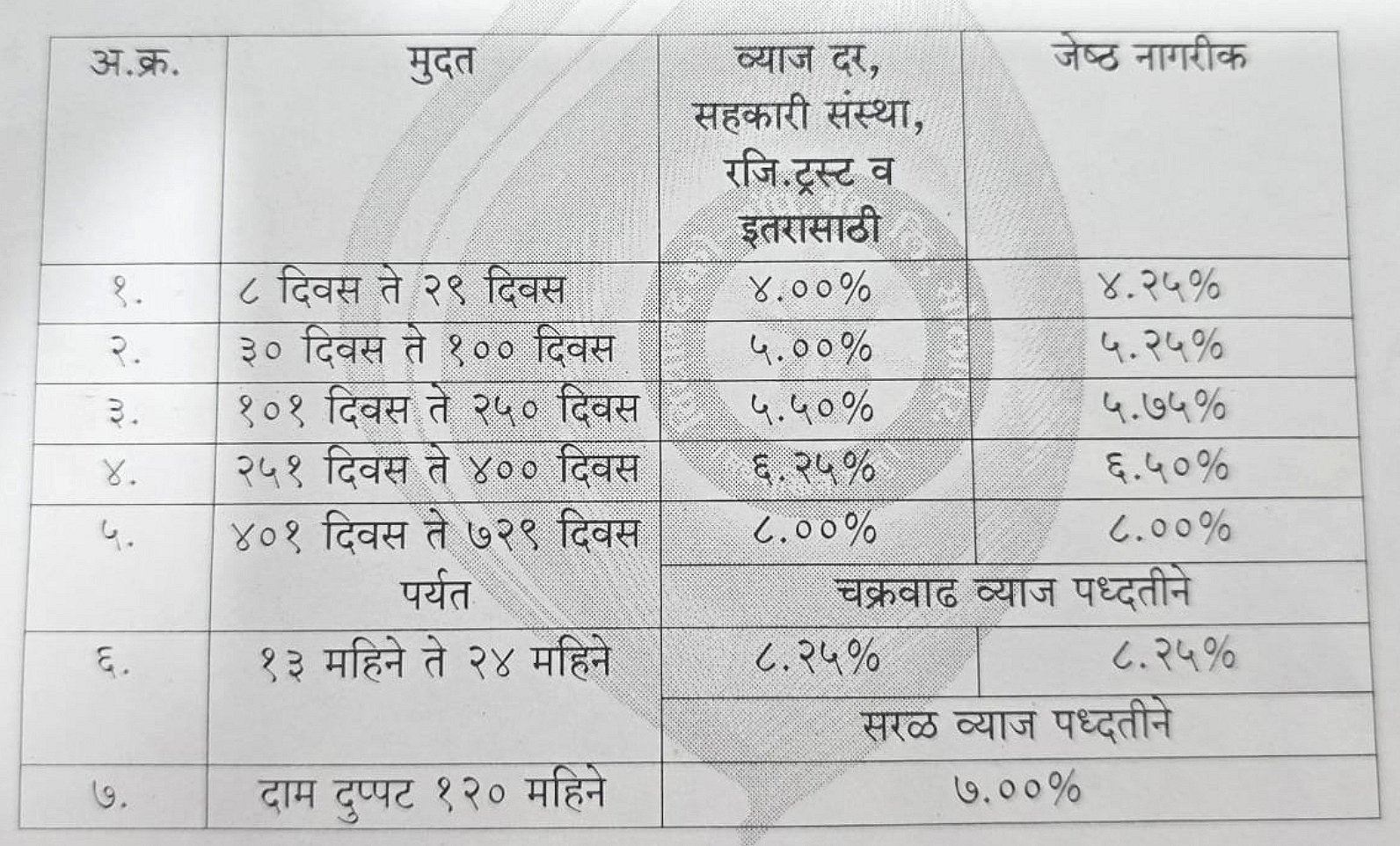

- Additional 0.25% interest for investment done by Senior Citizens, Pathsanstha's and Co-Op Societies for deposites of more than 30 days.

- No penalty for premature closure of deposits. For DAM DUPPAT deposits if premature of deposits happens then if deposits gets closed before 1095 days completion then he will get 4%, If deposits gets closed before 1825 days completion Interest will get paid by 7% and if deposit get closed after 1826 to 3375 days then he will get 7.50%.

- Avail loan facility on deposit account with only 1% higher ROI on deposit ROI.

- DIGC Insurance covered for deposit up to Rs. 500000/-.

- Individuals (Single or Jointly), Minor by Guardian, Institutions, Co-Op Societies, HUF can open deposit accounts.

- Nomination facility available.

Deposit Schemes

- Fixed Deposit: Interest gets paid on monthly or quarterly basis. Interest calculation is done by simple interest process.

- Reinvestment Deposit: Interest get calculated on quarterly basis by cumulative interest calculation method.

- Dam Duppat Deposit: Interest get Interest get calculated on quarterly basis by cumulative interest calculation method.